How Digital Transformation is Changing Audit Processes

Digital transformation is progressing – auditing is not excluded. Therefore, business leaders are increasingly challenged to think about the further development of audit processes to profitably integrate the advantages of digitalisation. This article demonstrates this using the customer journey approach.

© iStock.com/NicoElNino

Impulses in the Area of Financial Auditing

Innovations in the field of digital, automated bookkeeping in audited companies will have a significant impact on financial auditing. Innovative audit tools, new technological possibilities, and the time pressure from addressees to access audited financial figures more quickly after the balance sheet date, call for changes in the performance of annual audits.

Changes in the Performance of Financial Audits

Which changes in the execution of financial audits can be observed? The spread of purely electronically based audit documentation (digital audit dossiers) in auditing is becoming a reality due to major technological advances. The range of “audit tools” on the market, as well as the deployment of document management systems, actively contribute to this development.

However, digitalisation in auditing is not limited to electronic audit working papers. The exchange of data with the audited companies is also shifting to the digital world. With the positive effect of increased efficiency and cost advantages, the exchange of documents between audited companies and the audit firms is shifting to web-based data storage services (file hosting or file sharing). Data-exchange platforms have arrived in the data-synchronising world and are currently also covering auditing and fiduciary services. With the switch from paper to electronic working papers, powerful tools such as Excel-based analytical testing procedures will become essential.

It is time to remove the critical attitude towards data analytics that is still widespread in the audit profession in the age of “big data”.

Personal Experiences

Which experiences did Mattig-Suter & Partner gain with the digitisation of the audit processes? The audited companies did surprisingly well, regardless of the degree of digitisation of their business model and their organisational form of bookkeeping.

The data exchange via data-exchange gateway, which is hosted in-house for security reasons, was met with broad acceptance by the audited companies.

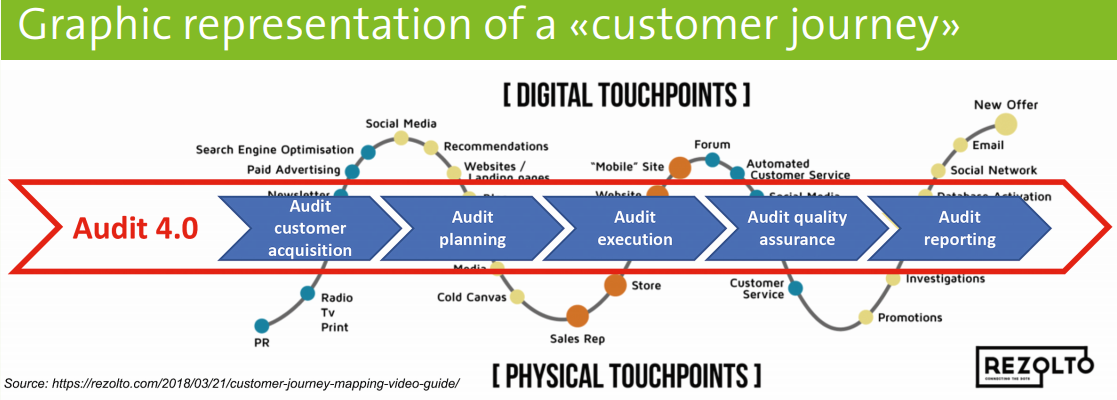

The data-exchange gateway developed into the central control instrument of the audit process. When building such a “customer process gateway”, Mattig-Suter & Partner used the basic ideas of customer journey mapping (refer to graphic below) to identify the critical digital and physical touchpoints from the perspective of the audited company and to better include the customer experience of the employees of the audited company.

The increased shift of communication into digital channels will have an impact on the relationship with the staff of audited companies and customer loyalty. The assessment of the quality of the bookkeeping and the integrity of the people involved continues to require personal contact.

Analysing data with digital tools and incorporating artificial intelligence will not be able to replace the professional judgment of auditors anytime soon, and personal assessments and experiences will not easily be digitalised.

Conclusion

A radical rethinking of one’s audit processes in terms of the customer journey map supports audit firms in the further development of audit services in the digital age.

Taking a customer-focused perspective in the process design does not conflict with requirements for independence; on the other hand, it promotes acceptance among the players in the audited companies and increases the quality of professional cooperation in the conduct of the audit.

Based on Confucius, the following conclusion may be drawn: “The (customer) journey is the reward.” Patience, continuity and a portion of serenity on the path to digital transformation are required from all sides, without losing sight of the desired goal.